The Supreme Court has said that it is mandatory to link the PAN with the Aadhaar for filing income tax returns. A bench of Justice AK Sikri and Justice S Abdul Nazir said that the apex court has already declared the order 139AA of the Income Tax Act as the ruling in this case.

The Supreme Court gave this direction on the Center’s appeal against order of Delhi High Court to allow Shreya Sen and Jayshree Satpura to file Income Tax return number without adding the income tax returns to the Aadhaar for the year 2018-19.

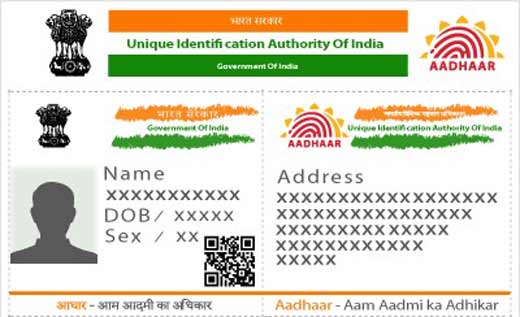

The bench said that the High Court had given this order in view of the fact that the matter is pending for consideration in the apex court. After this, since the apex court heard the verdict on September 26 last year and retained Section 139 AA of the Income Tax Act, it is therefore mandatory to link the PAN number with the Aadhaar card.

The bench, while settling the appeal of the Center, clarified that tax assessment will be filed in accordance with the decision of the apex court for the year 2019-20.

The five-member Constitution Bench, in its decision on September 26, 2018, had termed the Center’s aadhaar plan as constitutionally valid, that the basis for filing income tax returns and allotment of PAN numbers would be mandatory, but aadhaar is not necessary for bank accounts. Similarly, telecom service providers can not ask for a aadhaar number for mobile connections.

Dainik Nation News Portal

Dainik Nation News Portal