DAINIK NATION BUREAU

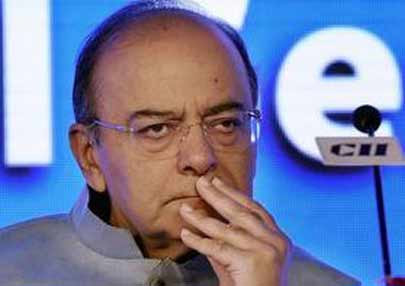

Taking cognizance on comments of Ex-Finance Minister Yashwant Sinha, union Finance Minister Arun Jaitley has explained to the nation that what finance ministry has done since he took charge of the ministry. He said that to bring transparency and fairness in the tax administration Income Tax Department has taken various initiatives in the last 2-3 years. Highlighting the initiatives, he said that a Single Page ITR-1 (SAHAJ) Form was introduced for tax payers having income up to Rs. 50 lakhs. Rate of tax for individuals having income of Rs. 2.5 lakhs to Rs.5 lakhs was reduced from 10 to 5, which is one among the lowest in the world. The concept of ‘no scrutiny’ was introduced for the First Time Non-Business Tax Payers having income up to Rs. 5 lakhs so that more and more people are encouraged to join the tax net and file their IT returns and pay the due amount of taxes. He expressed these views while addressing the Second Meeting of the Consultative Committee attached to the Ministry of Finance on the subject of “Initiatives of IT Department”” in Delhi on Friday.

Even corporate tax was reduced to 25% for companies with turn-over up to Rs. 50 crore thereby covering almost 96% of the companies. The new manufacturing companies incorporated on or after 1st March 2016 were given an option to be taxed at 25% without any deduction. The MAT credit was allowed to be carry forward up to 15 years instead of 10 years as part of procedural reforms.

In the field of e-Governance, Jaitley said that 97% of the income tax returns were filed electronically this year, out of which 92% returns were processed within 60 days and 90% refunds were also issued within 60 days. IT department also introduced Grievance Redressal System- E-Nivaran which integrated all the online and paper grievances and tracks them till their resolution. Every grievance is acknowledged and resolution is intimated through email and SMS.

Through E-Sahyog, all cases of information mismatch are handled in non-intrusive manner to avoid full investigation. Around 1.9 core salaried tax payers are being informed every quarter by the Income Tax Department of the amount of TDS deposited by their employers. With these initiative direct interaction between the tax assessing authorities and assesses have established. It has curbed the scope of corruption too.

As far as Ease of Doing Business and promoting Financial Markets are concerned then we have introduced Presumptive Taxation Scheme for Professionals having income up to Rs. 50 lakhs. Similarly, threshold for Presumptive Taxation Scheme for business income raised from Rs. 1 crore to Rs. 2 crore and companies located in International Financial Services Centre (IFSC) have been exempted from Dividend Distribution Tax and to pay MAT @ 9% only.

Now India has entered into Foreign Collaboration with 148 countries as far as Exchange of Information for tax matters is concerned and with 39 countries for criminal matters. As far as the drive against black money is concerned, the Income-tax Department has taken various initiatives since the present Government came to power. In this regard, the Finance Minister mentioned about the enactment of the Black Money Act, 2015, Comprehensive Amendments to the Benami Act 1988 and Operation Clean Money among others. After the intense follow-up of demonetization data from November 9, 2016- January, 10, 2017, about 1100 searches were made resulting into seizure of Rs. 610 crore including cash of Rs. 513 crore. The undisclosed income of Rs. 5400 crore was detected and about 400 cases have been referred to ED and CBI for án appropriate action.

To promote less cash economy and digital transactions, the Income Tax Department took various initiatives including penalty for cash receipt of Rs. 2 lakh or more, limit of cash donation to charitable trusts reduced from Rs. 10,000/- to Rs. 2000/- and no cash donations of Rs. 2000/- or more to political parties.

Defending the demonetization, FM said that the revenue collections in case of direct taxes rose to Rs. 8,49, 818 crore during the Financial Year 2016-17 at a growth rate of 14.5 per cent. The Finance Minister further said that net collections till September 18.2017 rose to Rs. 3.7 lakh crore with a growth of 15.7%. The number of tax payers increased from 4.72 crore in financial year 2012-13 to 6.26 crore during the last financial year.

Later various members of the Consultative Committee gave various suggestions about how to improve revenue collections and performance of the Department.

Dainik Nation News Portal

Dainik Nation News Portal